Given job profiles with paychecks in hand, an enthusiastic group of middle school students made their way to the mall, the car lot, the realty office and other places easy to spend money.

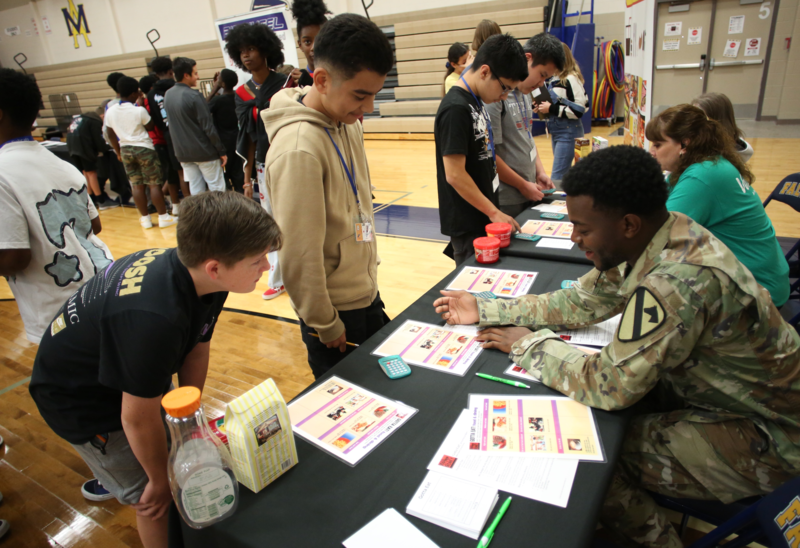

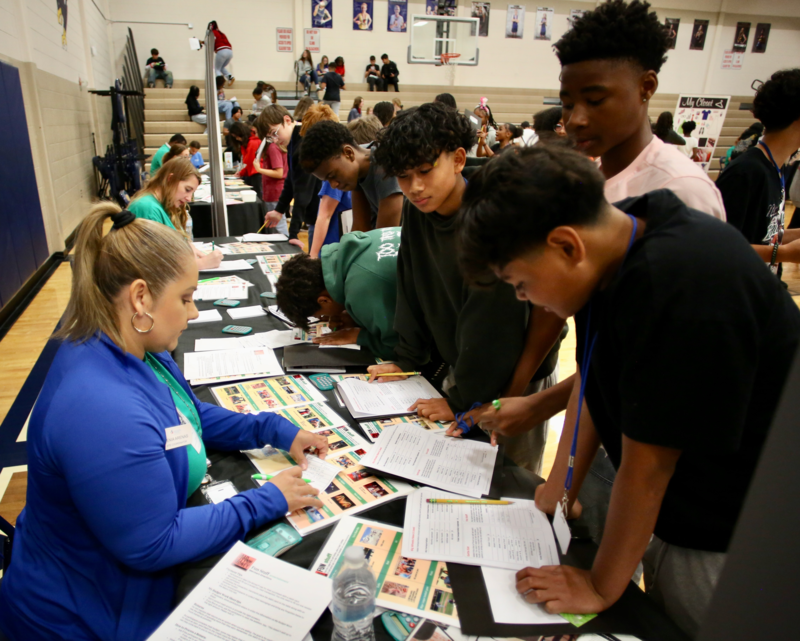

In an aptly named activity called Mad City Money, about 250 Audie Murphy Middle School students circulated through the school’s gym, visiting tables representing major life expenses.

With volunteers at each table selling goods and services, it didn’t take long for students to spend their paychecks on utilities, housing, childcare, vehicle, cell phone and groceries.

After the initial wave of spending, students took their notebooks containing their profile and their newly acquired receipts and sat down to figure the damages before heading to the bank for some financial counsel.

The financial literacy activity, a program of A-Plus Federal Credit Union seemed to make an impression. It was the second year that Audie Murphy hosted the activity for eighth grade.

“They give the eighth-graders this free simulation of budgeting,” said campus instructional specialist Ritia Lever. “They see how the real world is.”

“I learned that kids like to spend money. It’s a true eye-opener. They learn that ‘When my parents say they have to pay the bills and don’t have enough money they really probably don’t have enough money.’”

Her own daughter told her last year she never realized how much the necessities of life cost.

“It’s an amazing life experience for them,” she said.

The student profiles differ. Some have spouses and some don’t. Some have children and some don’t. They are also required to save a portion of their check and have something set aside for retirement.

Volunteers from Wal-Mart, the city of Killeen and the school’s Fort Hood adopt-a-school unit assisted, along with parents and available school staff members.

Eighth-grader Hannah North agreed the simulation was an effective learning tool. She assumed the profile of a bank teller with a husband and child.

“We have student loan payments, medical insurance and credit card debt,” she said. “We have to figure out our expenses like food and going out to eat, your car and all those expenses, home stuff and clothing.”

The scenario even included surprises like a needed car repair or a child’s broken bone to fit into the budget.

“It costs a lot for most things. You have to be very strategic and knowledgeable about your expenses. You don’t want to go into debt,” she said.

“It’s a fun way to learn. We’re learning a lot about taxes. It’s a fun way to learn how to use your money strategically and be knowledgeable.”

See a Mad City Money photo gallery here