- Killeen ISD

- Financial Transparency

Financial Transparency

-

Killeen ISD provides budget and financial information online to increase transparency and align with the initiatives of the Texas Comptroller for financial transparency. We have provided links to our annual comprehensive financial reports, adopted budget, historical tax rate information, FIRST Reports and debt obligations. Other information may be accessed on the sidebar.

Budget

-

The school district is required by law to prepare an annual budget for the General Fund, Debt Service Fund and School Nutrition. Following are the links to the original budgets adopted by the Board of Trustees.

- FY 2025 Adopted Budget by Function

- FY 2024 Adopted Budget by Function

- FY 2023 Adopted Budget by Function

- FY 2022 Adopted Budget by Function

- FY 2021 Adopted Budget by Function

- FY 2020 Adopted Budget by Function

- FY 2019 Adopted Budget by Function

- FY 2018 Adopted Budget by Function

- FY 2017 Adopted Budget by Function

- FY 2016 Adopted Budget by Function

- Archives

Financial Summary

-

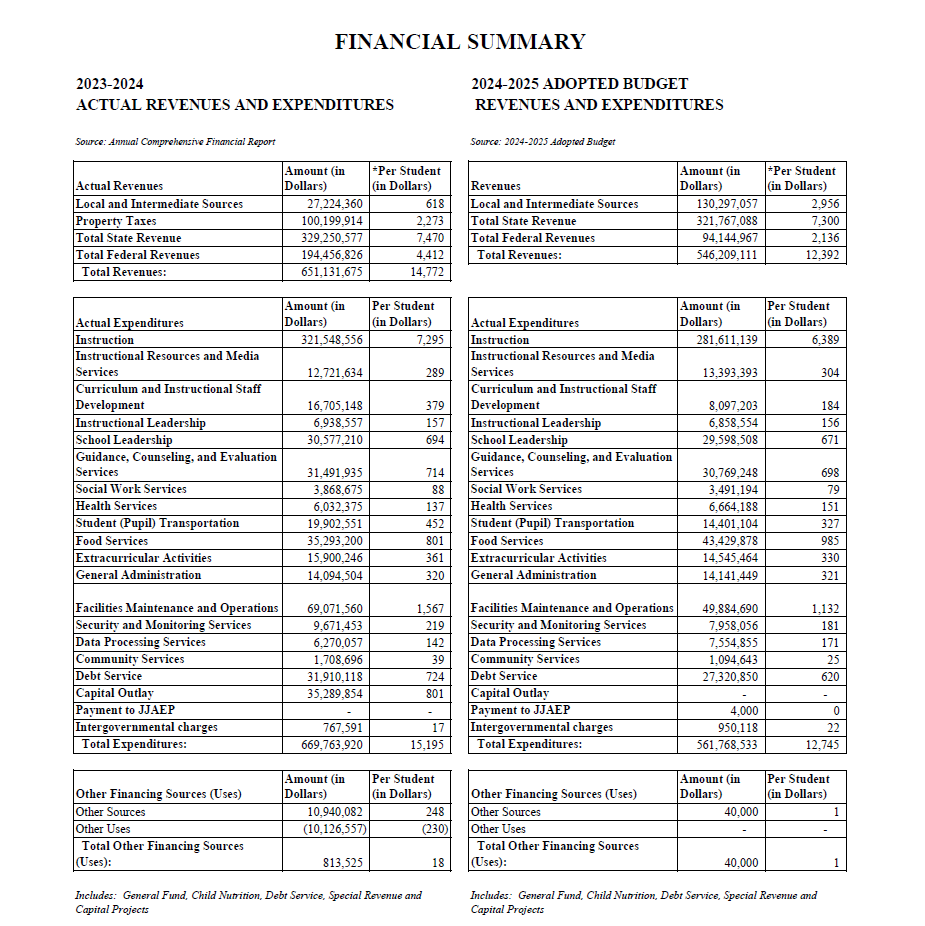

The data below is from Killeen ISD's Audited Governmental Fund Statements in the District's Annual Comprehensive Financial Report for the year ended August 31, 2024. Governmental Funds include the General Fund, Special Revenue Funds, Debt Service Funds and Capital Project Funds.

Please click here for a breakdown of the major funds actual revenue and expenditures.

Revenues and Expenditures per Student

-

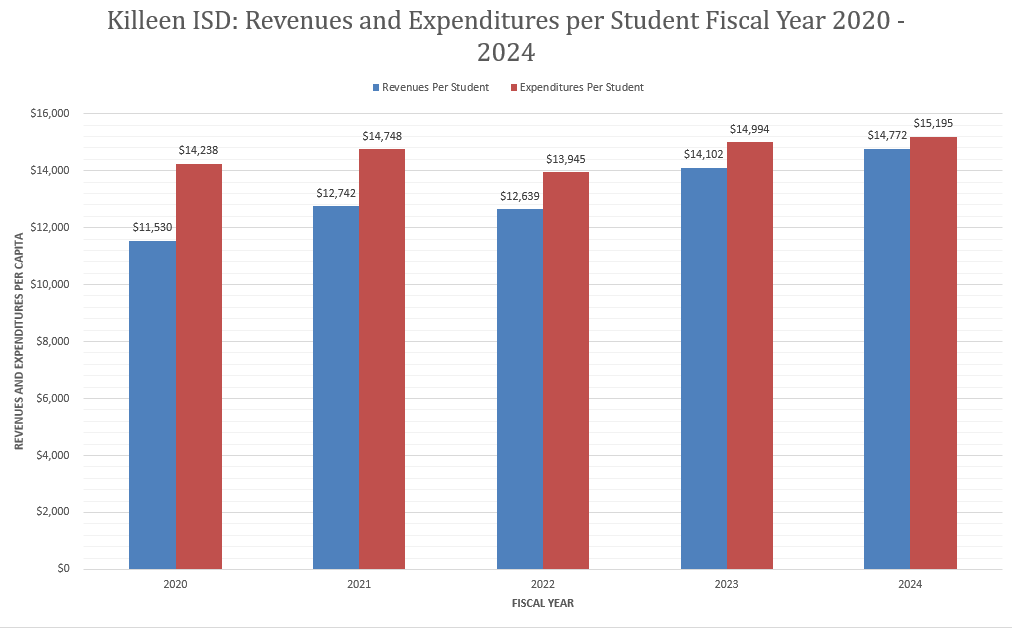

The total revenues (General Fund, Child Nutrition, Debt Service, Special Revenue, and Capital Projects) per student as of August 31, 2024 is $14,772.00 and total expenditures per student is $15,195.00. The enrollment numbers are based on the 2024 PEIMS Peak Enrollment of 44,079.

Revenues and Expenditures per Student Fiscal year Revenues Expenditures 2020 11,530 14,438 2021 12,742 14,748 2022 12,639 13,945 2023 14,102 14,994 2024 14,772 15,195

Includes: General Fund, Child Nutrition, Debt Service, Special Revenue and Capital Projects.

Property Tax Rate

-

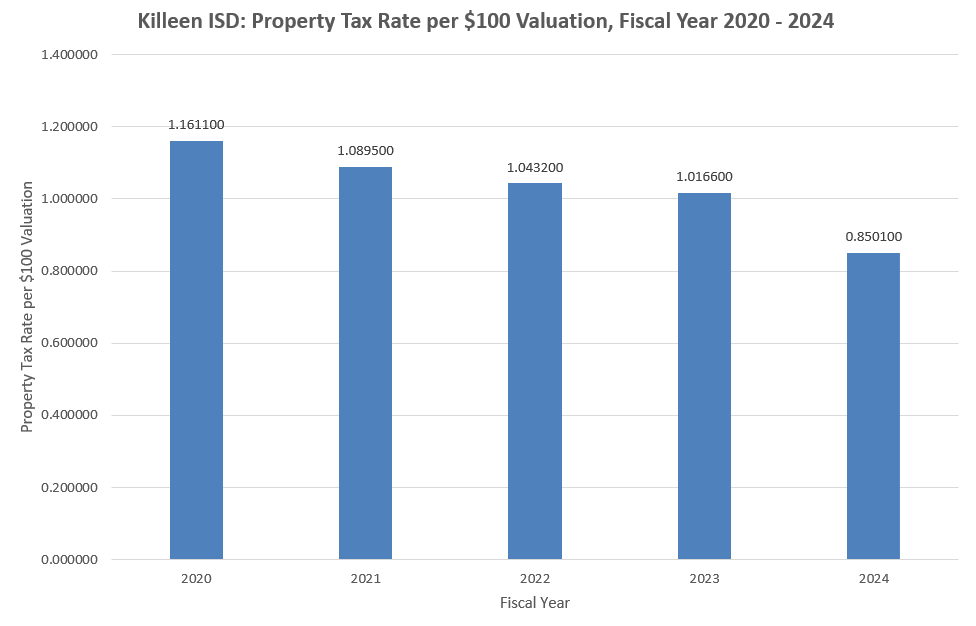

Property tax is a levy on property that the owner is required to pay. The tax is levied by the governing authority of the jurisdiction in which the property is located.

Total property tax revenue for KISD for the year ended August 31, 2024, was $100,094,998.00 This represents $2,271.00 per student.

You may access the information to KISD’s Historical Tax Rates here.

Tax Rate Information

2024-2025 Adopted Tax Rate: $0.8758

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

You may request the same information from the assessor of each taxing unit for your property by requesting their contact information from your county’s assessor at:

Tax Appraisal District of Bell County

Billy White

411 Central Ave

Belton, Texas 76513

254-939-5841

Annual Comprehensive Financial Report

-

Killeen ISD Full-Time Equivalent Employees (FTE)

Killeen ISD had 7,612 full time equivalent positions as of August 31, 2024. Full time equivalent is a unit that indicates the workload of an employed person in a way that makes workloads comparable across various contexts.

-

First Report

The Financial Integrity Rating System of Texas is administered by TEA to ensure the Texas Public Schools are held accountable for the quality of their financial management practices. Killeen ISD received a superior rating for 2023-2024 (based on 2022-2023 data).

Check Registers

Contact Us

-

KISD Business Services

Kallen Vaden

Chief Financial Officer

(254) 336-0157Melanie Jones

Director of Financial Reporting

(254) 336-2755 -

Board Members

Brett Williams

Board President

(254) 338-0717Susan Jones

Board Vice President

(254) 290-0383Marvin Rainwater

Secretary

(254) 394-2608Tina Capito

Board Member

(254) 462-7712Rodney Gilchrist

Board Member

(254) 833-6690Brenda Adams

Board Member

(254) 289-0105Oliver Mintz

Board Member

(254) 291-5807 -

Fort Cavazos Advisor

Col. Stokes

Fort Cavazos Garrison Commander

(254) 287-7901 -

School Administrator

Megan Bradley

Deputy Superintendent

(254) 336-0002